Small Business Line of Credit

Access cash–when you need it–with a line of credit

What is a business line of credit?

A business line of credit is a revolving loan that allows access to a fixed amount of capital, which can be used when needed to meet short-term business needs. A business line of credit is the best financing option when you need extra working capital to cover recurring business expenses or bridge cash flow gaps. With ongoing access to funds, you have the flexibility to withdraw only what you need, when you need it—and pay for only what you use. So, you’ll be prepared for whatever challenges and opportunities come your way.

Benefits of an Orox Equities Business Line of Credit

Revolving lines of credit

from

$10K-$500K

12-month repayment

term, resets after each

withdrawal

Automatic weekly

payments

How a Orox Equities Line of Credit Works

01 Apply Online

Provide basic info about your business and get a decision in as fast as 5 minutes.

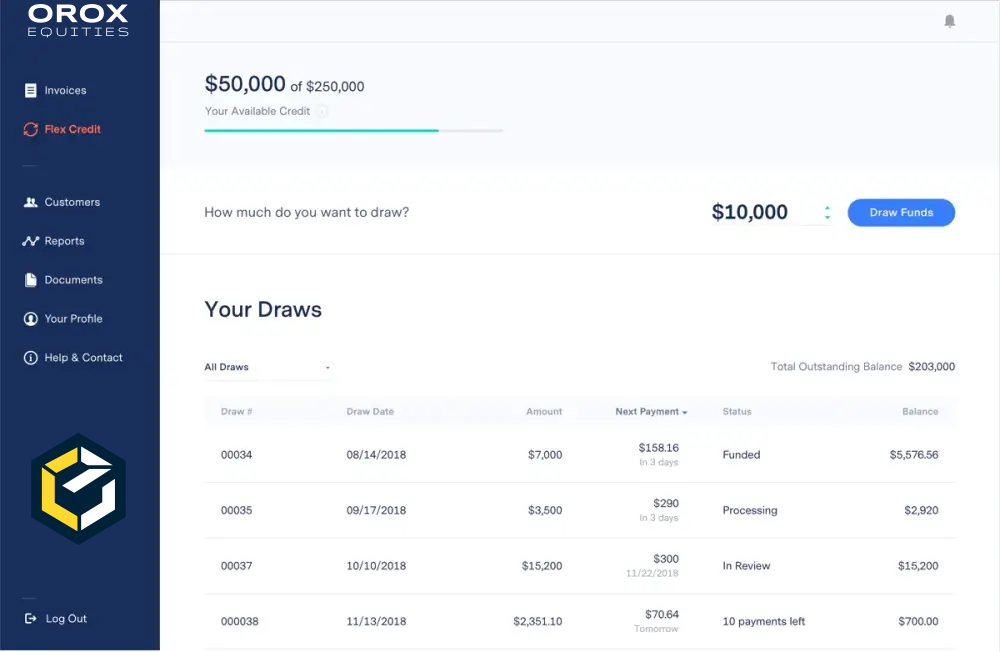

02 Draw funds

Request funds through your online dashboard and see them in your account within hours.

03 Make repayments

04 Access more funds

Real, personal support

With Orox Equities, you get a dedicated account rep to help you every step of the way.

Email us at admin@oroxequities.com

What you need to get started

Minimum qualifications

600+ FICO

6+ months in business

$10,000 in monthly revenue

Business is operating or incorporated in an eligible U.S. state

What you need to apply

Basic details about you and your business

Bank connection or year-to-date bank statements

How other small business owners have used their Orox Equities Lines of Credit

“We used the money from Orox Equities to consolidate our business credit card debt, help maintain the inside of the building, and buy some new equipment. We also used the line of credit to provide maintenance for the air conditioning, so we’ve been able to use that funding to keep this beautiful business going and our business running efficiently.”

Andrea Piacquadio

Perfect Circle Donuts Company

Houston, TX

“I have used both a term loan and a line of credit from Orox Equities to sustain my clothing brand. Any business owner knows that your revenues can change, but expenses do not. You need to borrow a little until finish the new line so you can keep paying your bills, make payroll, etc.”

Daniel Xavier Maza

Street House

Wooside, NY

“Without financing, we would not be able to grow the business. We would have had to come up with other sources of cash or wait until the business generated enough cash to be able to grow. About 70% of the money we borrowed went to buy new inventory, and about 30% was for create new line of products and other operations.”

Additional resources on business lines of credit

Business Line of Credit vs. Business Credit Card

A line of credit is a revolving loan that provides a fixed amount of working capital that can be accessed as needed. All or part of the credit line can be accessed at any given time up to the fixed limit, repaid, and used again. Interest is only paid on the amount of credit used. A business credit card is also a very popular and flexible financing and purchasing tool for those times when business owners need quick access to cash.

While business credit cards are similar to business lines of credit and are both used by small business owners on a regular basis, there are some purchases or payments that can’t be made with a business credit card. For example, you may not be able to make certain payments including your property lease, payroll, and invoices from vendors; but you can use the funds from your business line of credit. Additionally, while some business credit cards come with lower credit limits, an Orox Equities business line of credit is between $10,000 and $500,000.

Secured vs. Unsecured Business Lines of Credit

There are different types of loans for different types of business needs. One type of lending common for small business is asset-based lending. Asset-based lending can be any lending product that uses an asset as collateral for the loan, or in this case, a line of credit. In the event the borrower defaults on the loan, the lender can take possession of the asset. Assets can include things like real estate, equipment, inventory, accounts receivable, or cash accounts. These assets can be pledged as collateral to back new loans, and whether they are used as collateral determines whether the loan or line of credit is “secured” or “unsecured”.

A secured business line of credit requires a business to pledge assets as collateral to secure the line. Since a line of credit is a short-term liability, lenders typically ask for short-term assets, such as accounts receivable or inventory. If the borrower is unable to repay the line, the lender may proceed to assume possession of the collateral and sell the asset in order to pay off the balance.

An unsecured business line of credit does not require a business to pledge assets as collateral to secure the line. Unsecured lines of credit typically require the business owner to have a strong credit profile and credit score, along with a positive business track record to qualify. In general, unsecured lines of credit have slightly higher interest rates and line sizes are relatively smaller.

Ready to Apply?

Submit your application in just a few minutes.